New Delhi, 18/12/2024: In a strategic move aimed at strengthening its footprint in the global metals and mining industry, Vedanta Limited has announced a major investment of $2 billion in copper projects in Saudi Arabia. This initiative forms part of a larger wave of international investments in the kingdom, which recently secured nine deals totaling over 35 billion riyals (approximately $9.32 billion) with prominent global companies, including China’s Zijin Group.

The agreements were officially unveiled at the World Investment Conference held in Riyadh, under the framework of the Global Supply Chain Resilience Initiative. This initiative is a cornerstone of Saudi Arabia’s National Investment Strategy, which itself is closely aligned with the country’s ambitious Vision 2030 plan. Vision 2030 seeks to diversify the Saudi economy, reducing its long-standing dependence on fossil fuels while fostering industrial and technological growth. The kingdom has set an ambitious target of attracting $100 billion in foreign direct investments annually by 2030, and last year it had already achieved more than a quarter of this goal, signaling strong investor confidence.

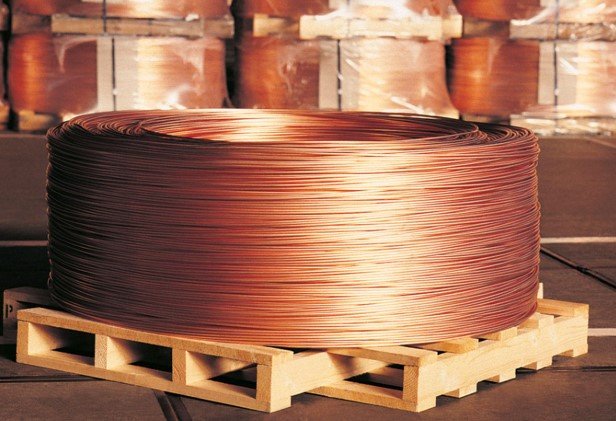

Vedanta’s $2 billion investment will be directed toward the development of copper facilities at Ras Al-Khair, one of Saudi Arabia’s key industrial hubs. The planned infrastructure includes the construction of a smelter and refinery with a combined capacity of 400,000 metric tons per annum (tpa), alongside a 300,000 tpa copper rod manufacturing plant. The project is expected not only to meet domestic demand for copper, ensuring self-sufficiency, but also to contribute approximately 70 billion riyals to the kingdom’s economic growth over time. By establishing such large-scale facilities, Vedanta positions itself as a key partner in Saudi Arabia’s strategy to expand its industrial base and secure critical mineral supply chains.

Alongside Vedanta, China’s Zijin Group will also make a substantial investment in Saudi Arabia’s mining sector, committing between 5 billion and 6 billion riyals in multiple phases. The initial phase will see the establishment of a zinc smelter with a production capacity of 100,000 tpa for zinc ingots and 200,000 tpa for sulfuric acid. Subsequent phases will focus on lithium carbonate extraction and the construction of a copper refinery, targeting production levels of 200,000 tpa of copper cathodes and 50,000 tpa of electrolytic copper foil.

Australia’s Hastings Technology Metals is another significant player entering the Saudi market, planning an investment of between 5.6 billion and 7.2 billion riyals to build processing facilities for rare earth elements. These facilities will include a hydrometallurgical processing plant and a solvent extraction separation facility, sourcing raw materials from domestic mines.

Additionally, in partnership with Ajlan & Bros Mining, Vancouver-based Platinum Group Metals is conducting feasibility studies for a platinum group metals smelter and base metals refinery valued at 1.9 billion riyals. This project will utilize feedstock sourced from South Africa’s Waterberg mine, highlighting the cross-border nature of the investments and the kingdom’s appeal as a global mining hub.

Collectively, these investments underscore the growing international interest in Saudi Arabia’s mining sector. They reflect the country’s increasing importance in the global metals and minerals market and its potential to generate significant economic growth, in line with the long-term objectives of Vision 2030. Through such initiatives, Saudi Arabia aims to solidify its position as a global center for mining, industrial production, and technological development, attracting further international investment and expertise in the years ahead.